At 68 and ½ years old I finally know

what I am worth......

Don’t know

if you have ever asked yourself what are you really worth? And no, it has

nothing to do with your fortune, properties, savings or net worth. But in the

eyes of insurability.

Let’s go

over some background information: According to The

New England Journal of Medicine published a study in 2018, reporting that

the most productive age in human life is between 60-70 years of age.

And the second

most productive group of human beings is from 70 to 80 years of age. Followed by

the third most productive the younger of the two aforementioned is 50 to 60

years of age.

Back to the subject,

insurability.... Yes, insurance tables and your worth have nothing to do with

your productivity, your work ethics, your dedication to all around you and all

those people and entities that rather ask you for help knowing how busy you

could be.

Benjamin Franklin once said: that "if you want something done, ask a

busy person." There's truth to that statement. After all, the busier

we are, the better we manage our time. Busy people are able to get more done in a day because they

don't waste time

And let’s get to

the meat of the subject. Insurability, how it is measured, and is it still

applicable? When societies are talking

about raising the retirement age, and we are living longer. Us Life expectancy

has gone from 68.14 years to 79.25 from 1950 to 2023 and still we consider that

your final days are more valuable, or devalued for the fear of paying you out.

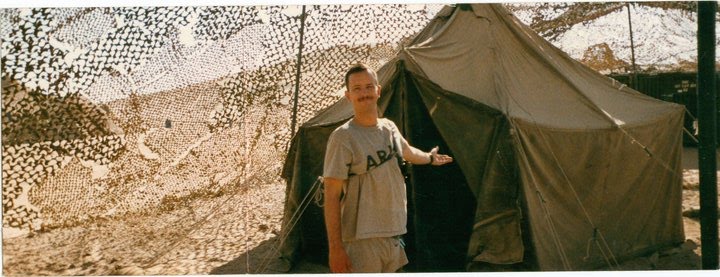

At an early age

of 23, as a lieutenant in the Army, a retired US Army LTC sold me, my first

whole life insurance policy with as many riders as possible: double indemnity,

accidental death, insurance for an unborn child.... wow he made a killing on

commission. Needless to say, didn’t have a child until ten years later. But you

learned, and from my 33rd year of life it has been Term insurance

all the way, best bang for the buck but no cash value. I saw the industry

evolve to “Universal life, and other sporty names, but kept firm with my 10-15-year

terms until last year, when my provider sends me a letter saying this is the

end. And from there on convert to whole life or pay some ludicrous amount. That was they day I started questioning myself

what I was truly worth. But still it took one more year until yesterday, when I

had to make the decision and called them up to say, that it would not renew

that policy and to get me coverage for the same amount of money I have been

paying for the last 30 years and they did, And what it all ended up being was

that I could only get 1/5 of what I had a day ago. My $500,000-dollar policy became a $100,000

policy just like that.

So today I am

worth 1/5 of what I was worth yesterday, and the last 14 years of my life have

been the most active, the most involved, the most productive of my last 30

years or my entire life, but the fact is I am 68.5 years old is what matters to

the insurance world, so I have depreciated in one day more than a new car sold

taken out of the lot (13%) in my case 20%.

That is the way,

as the Mandalorian creed says... insurance measures your probabilities in the

later part of your life, fortunately my children are very well educated and my

wife will be taken care of. So, for the

next ten years I will leave behind only 1/5 of myself to whom shall ever

survive me.

So, do the

mental drill, invest in your future, leave behind educated children that can

earn a living by themselves. And hopefully

leave no debt for your survivors.